See if you are as ready for retirement as you think you are.

It can be shocking to hear how many people spend more time planning their vacation or next mobile phone purchase than planning for retirement.

It is hard to imagine that they are expecting Social Security will take

them through their golden years. A person who has paid in the maximum

each year to social security can assume to receive about $30,000 a year.

Every adult in the work force, should go to SSA.gov to find out what they can expect based on their planned retirement age. Since it probably won’t be the amount you need to retire comfortably, at least you’ll know how much you’ll be short so that you can devise an investment plan.

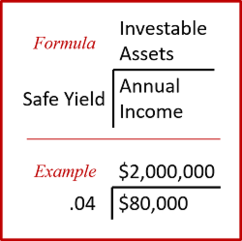

There’s an easy rule of thumb used to estimate the investable assets needed by the time they retire to generate a certain income. The target annual income is divided by a safe, conservative yield to determine the investable assets needed.

A person who wants $80,000 annual income generated from a 4% investment would need investable assets of $2,000,000. If a person had $500,000 now, they would need to accumulate $1.5 million more by the time they retire. They would need to save about $100,000 a year to be ready for retirement in 15 years.

If saving that amount does seem possible, an IDEAL alternative could be to invest in rental homes. The familiarity of rental homes like owning a personal residence can reduce some of the risk. Rentals also enjoy other characteristics like income from the operation, depreciation in the form of tax shelter, equity buildup from the amortization of the loan, appreciation and leverage from the borrowed funds controlling a larger asset.

Some investors explain the strategy by buying good rentals with mortgages and having the tenant to retire the debt for you. Single family homes offer the investor an opportunity to meet their retirement and financial goals with an investment that is easily understood and controlled.

A Retirement Projection calculator can give you an idea of how many rental homes you’ll need to supplement your social security and other investments.